Analyzing the Feasibility

of Missing Middle Housing in Edgehill

The Metropolitan Nashville-Davidson County Planning Department released a Draft Edgehill Neighborhood Plan on July 11, 2024.

The plan proposes to rezone low-density residential blocks of the Edgehill neighborhood to allow “Missing Middle” housing typologies, in an effort to enable more accessible price points in a hyper-gentrifying district.

The plan included limited direction as to the form and substance of Missing Middle allowances and was not accompanied by a feasibility analysis.

This independent analysis supplements the Edgehill Neighborhood Plan (hereafter referred to as the “Plan”) with a study of Missing Middle housing typologies, development feasibility analysis, and recommendations.

Summary of Methods + Findings

Methods

The analysis uses public property records from Metro Open Data and the Property Assessor of Davidson County to understand trends in small-scale housing development in Edgehill, with an emphasis on the period from 2010 to present.

Relevant points of study include:

the pace of new small-scale housing development

physical characteristics of new small-scale housing units

sale price, land cost, and other economic trends

With this analysis, parameters have been developed to analyze future development. Nine Missing Middle development prototypes were created and analyzed based on a basic development pro forma inclusive of construction and project costs, rents and sales prices, and land reversion value to determine the feasibility of each prototype on every parcel in the study area.

This is a working study and may be further refined. A full report will be published upon completion and include more detailed neighborhood and demographic context, development trend analyses, and Missing Middle typology tests.

Findings

Key findings of the study include:

Value Lock-in and Survivorship Limit Viable Parcels

Small-scale development activity has substantially slowed in Edgehill since its peak in 2017. Drivers of this downtrend are: the “low-hanging fruit” has been picked; remaining parcels are primarily comprised of newly-built units or more substantial, valuable pre-war homes; and higher construction costs have limited development margins. The most economically potent Missing Middle prototypes in the study are viable on only around 20% of eligible parcels in Edgehill.High Threshold for Missing Middle Viability

This study finds that parcels in Edgehill require at least 6,000 square feet of total floor area in new-builds to be viably redeveloped. For Missing Middle typologies to supply substantial (500+) new units, parcels must be developed with over 9,000 square feet of total floor area. At this scale, units produced will sell at $500k to $1.4mm and rental units will not be economically viable. The bulk standards required to deliver this level of density also may conflict with compatibility goals of the Plan.

Edgehill Has Outgrown Missing Middle as a Tool for Moderately-Priced Housing

The Plan calls for an Urban Design Overlay (UDO) to shape future redevelopment in the residential area. This future document should be crafted on a parcel-by-parcel basis to encourage assemblage of adjoining parcels with redevelopment potential to enable mid-rise flats and other multifamily types more suited to highly-accessible, high-value land. Recommendations will be included in a companion policy brief: Policy Design for Diverse Housing Options in Edgehill

Opportunities Exist to Balance Conservation with New Development

While there are few viable opportunities to provide differentiated housing options with Missing Middle typologies in Edgehill, there are a handful of potential assemblages in pockets of the neighborhood where historic character has been substantially eroded. Policies should be designed specifically for these sites to promote mid-rise, ownership-oriented multifamily which has been missing from the mix in Edgehill to date.

Neighborhood +

Demographic Context

This study assumes a basic familiarity with Nashville, the Edgehill neighborhood, its history, and current trends. A few highlights and additional notes:

Since 2000, the population of Edgehill has shifted from 79% Black and 17% white to 46% Black and 45% white

According to the 2018-2022 ACS, only 15 Black renters remain in the neighborhood quadrant (northwest) closest to The Gulch and Midtown—down from 59 in 2010 and 71 in 2000

In the remainder of the neighborhood, Black renter population counts closely correspond to the number of income-restricted housing units and the number of Black people living in poverty, which indicates that the majority of Black renters who remain in Edgehill are LIHTC/public housing residents

A similar pattern of spatial disparity is seen in median household income variance between the Census Block Groups which comprise Edgehill—the northwest quadrant, which flipped from 85% Black in 2000 to 84% white by 2020, boasts a median household income nearly five times that in the southeast quadrant, where LIHTC/public housing dominate the existing stock

Per capita incomes rose more than 150% from 2015 to 2021, but those gains were made almost exclusively by white and Asian newcomers

While average mortgage payments have grown from $1,500 in 2015 to over $2,500 in 2021, the percentage of income consumed by mortgage payments has fallen by nearly half—indicative of an ability for wealthy new entrants to access high-end housing that remains inexpensive relative to nearby neighborhoods such as 12 South and Belmont-Hillsboro

A development boom in the mid-2010s was driven by purpose-built Short Term Rental (STR) properties—although regulations have since changed to restrict STRs within residential zones, many of the housing units built during this period retain grandfathered STR permits

Nearly 1,000 new housing units (close to a 50% increase) have been added since 2000—two large apartment complexes have contributed around half of that sum, with another 3,200 apartment units approved for development

In light of these trends, the Plan is organized around three goals:

Retain, Preserve and Return

Edgehill should remain a place for long-time residents and preserve its central neighborhood character. Limit displacement and expand housing options. Explore ways to honor Edgehill’s culture and history.Inclusive, Smart Growth

Edgehill should be an affordable and accessible place to live. Growth should focus on the corridors of 12th and 8th Avenues. Future development should not lead to further displacement or negatively impact lower density portions of the neighborhood.Reconnect and Elevate

Enhance and celebrate the parks and landscape that make Edgehill so special, and bridge barriers created through Urban Renewal. Honoring the community’s history, reconnect the neighborhood parks to Fort Negley, and streamline connections around the neighborhood.

Key THemes

Edgehill is a historically-Black neighborhood which has substantially gentrified since 2000 and is trending toward hypergentrification.

Proximity to Downtown, The Gulch, Midtown, Vanderbilt University, and Belmont University have driven intense demand and land prices.

There are few remaining Black renters in market-rate housing. Black homeowners are also less numerous than in 2010, but remain common.

Much of the new development has taken two forms—large rental apartment complexes and massive ownership units in 2-on-1 Horizontal Property Regimes (HPRs)—with few options in between large units or large buildings.

Can Missing Middle present a solution?

Analysis of Development Trends

Development in Edgehill since 2010 has been marked by rapidly escalating prices driven by a homogeneity in unit types and large unit sizes. Scroll through the dashboard below for an annotated overview of trends in the form, scale, and composition of new development in Edgehill—don’t miss the page turner at the bottom of the dashboard, marked 1-5.

With rapid redevelopment in the mid-2010s, there are now relatively few parcels which are economically viable to redevelop under current zoning and land use policy. This dwindling supply of land has driven an increase in land prices, which are now approximately $600,000 per parcel. Higher construction costs have likewise limited new development and necessitated more expensive new housing units relative to land value.

These factors create a feedback loop. As new development becomes viable, builders compete for land sites by offering higher prices to owners. The higher prices necessitate larger, more expensive units. As the upscale segment becomes established in the submarket, the price a builder is able to pay for the land—known as the land reversion value of development—increases along with landowners’ price expectations. Meanwhile, with the bottom end of the market eroded due to teardowns, smaller houses on underdeveloped lots escalate in price due to demand from buyers willing to pay up for location—and thus further raises the threshold to realize development potential. The result is higher prices at all segments, a distorted bottom end, and an ultra-upscale top end of the submarket.

Land price feedback loops rarely reverse, absent broad economic distress. In order to avoid hypergentrification, policy must change to allow land costs to be divided among more housing units. This can lead to “land lift” by increasing the land reversion value of new development, but can also create economic space for inclusionary housing programs.

The relative affordability of higher density is shown in the dashboard below. New single-family houses are valued approximately 60% higher than 2-on-1 HPR duplex units and townhomes. The greatest affordability gains are achieved by smaller units, which are most easily provided in stacked condominiums—median values for condos are half the value of HPRs and townhomes, and one-third the value of single-family houses, despite higher per-square-foot values.

Analysis of Development Potential

Land does not have inherent value—it is the use of land which determines land value. When the current value of a land use exceeds the potential value of an alternative land use, the current use is “locked in” as the highest-and-best use and can be considered economically shielded from redevelopment.

As the dashboard below demonstrates, the value of a parcel is closely correlated with the intensity of development. Therefore, more intensely developed parcels are more likely to be locked in to their current use than more sparsely developed parcels.

One metric to assess the likelihood that a parcel is not currently developed to its highest-and-best use is the share of land value relative to total parcel value. Land use economists have found that a 60% land share is a common threshold for redevelopment viability. In Edgehill, just over one-quarter of residential-zoned parcels have a greater than 60% land share. Without accounting for land lift from potential upzoning, there are 222 parcels which may be likely to redevelop into more intense forms.

A goal of Missing Middle zoning change is to ensure that these 222 parcels, when redeveloped, do not continue the current trend of ultra-upscale development and offer units accessible to a greater share of the population.

Analysis of potential lock-in effects can inform assessments of the potential zoned capacity enabled by Missing Middle zoning reform. After controlling for land share, this analysis find that there are currently 259 dwelling units on 222 potentially viable parcels—another indication that displacement from Missing Middle reform is unlikely to be significant, as most single-family homes in Edgehill are owner-occupied.

A study of potential Missing Middle prototypes, discussed further in the following section, found that small lots may not be able to achieve the total floor area required to enable redevelopment. The dashboard below analyzes potential zoned capacity and lot sizes, which found that more than three quarters of potentially viable lots boast frontage of 50’ or wider and depth of 150’ or greater—dimensions which support the Missing Middle prototypes.

Missing Middle Prototypes

To assess the potential for Missing Middle in Edgehill, nine prototypes were developed based on current bulk standards and tested for financial viability with a pro forma model. These prototypes do not represent every possible form of housing or mix of units—however, these are the types most likely to be realized. First, a few notes on Missing Middle forms that did not make the cut:

Stacked Flats

When more than two units of housing are arranged vertically, construction must conform to the International Building Code (IBC) rather than the International Residential Code (IRC) used for detached and semi-detached housing types. The IBC is generally more stringent and labor availability is more constrained than IRC construction, which results in higher construction costs for vertically-arranged units. This analysis found that potential improvements to design efficiency and density for stacked flats did not overcome the higher costs associated with IBC construction. Although local legislation is pending to allow IRC in “Large Unit Homes” up to four units, buildings will be restricted to 5,000 square feet—below the threshold of floor area required for viable redevelopment in Edgehill.>6 Unit Projects

Small apartment/condo buildings arranged as stacked flats may be viable with more than six units; however, parking becomes a problem at this level of density. Typical parcels in Edgehill are able to supply four alley-loaded surface parking spaces and two on-street parking spaces. Parking-lite for-sale housing is an untested product type in the Nashville market—many builders and lenders remain skeptical toward the marketability of projects without dedicated parking. While this analysis is more generous toward parking-lite projects and did not penalize the denser prototypes as heavily as some builders might, it assumes for-sale projects are not currently marketable with a ratio of less than one dedicated off-street and/or readily available street parking space for each unit. While this may change as Edgehill grows more walkable and transit service improves, this analysis concludes that larger sites where off-street parking can be more efficiently arranged will be required for denser projects under current market conditions.

Each prototype was tested as a for-sale product to determine land reversion value—the price that a builder will be able to pay to acquire a parcel of land to develop the prototype. For prototypes that generate land reversion value high enough to be viable in Edgehill, the prototype was then back-tested for viability as a rental project. After applying a market capitalization rate (6%) and a market expense ratio (40%) to the value of the prototype as a for-sale product to determine required net and gross income, this analysis found that each prototype would require monthly rents greater than $3.19 per square foot—a similar level of rent to small units in new, highly-amenitized luxury apartments in the Downtown Nashville submarket. These rents are not broadly achievable for large unit types in the Edgehill submarket. Therefore, this analysis suggests that new Missing Middle development will be oriented to the for-sale market.

Prototypes were developed to be applicable to the largest number of potential lots. Parcels deeper or wider than 50’ x 150’ may be amenable to different designs, such as tandem parking or alternative site arrangement.

Finally, the mix of units realized by Missing Middle reforms may vary based on builders’ assessments of marketability. In particular, builders may find that denser (5+ unit) projects may benefit by offering two or three smaller units without dedicated parking in order to reserve limited parking spaces for larger, more upscale units. These prototypes are not intended to be exhaustive or inclusive of all potential options, but rather to identify key drivers of viability.

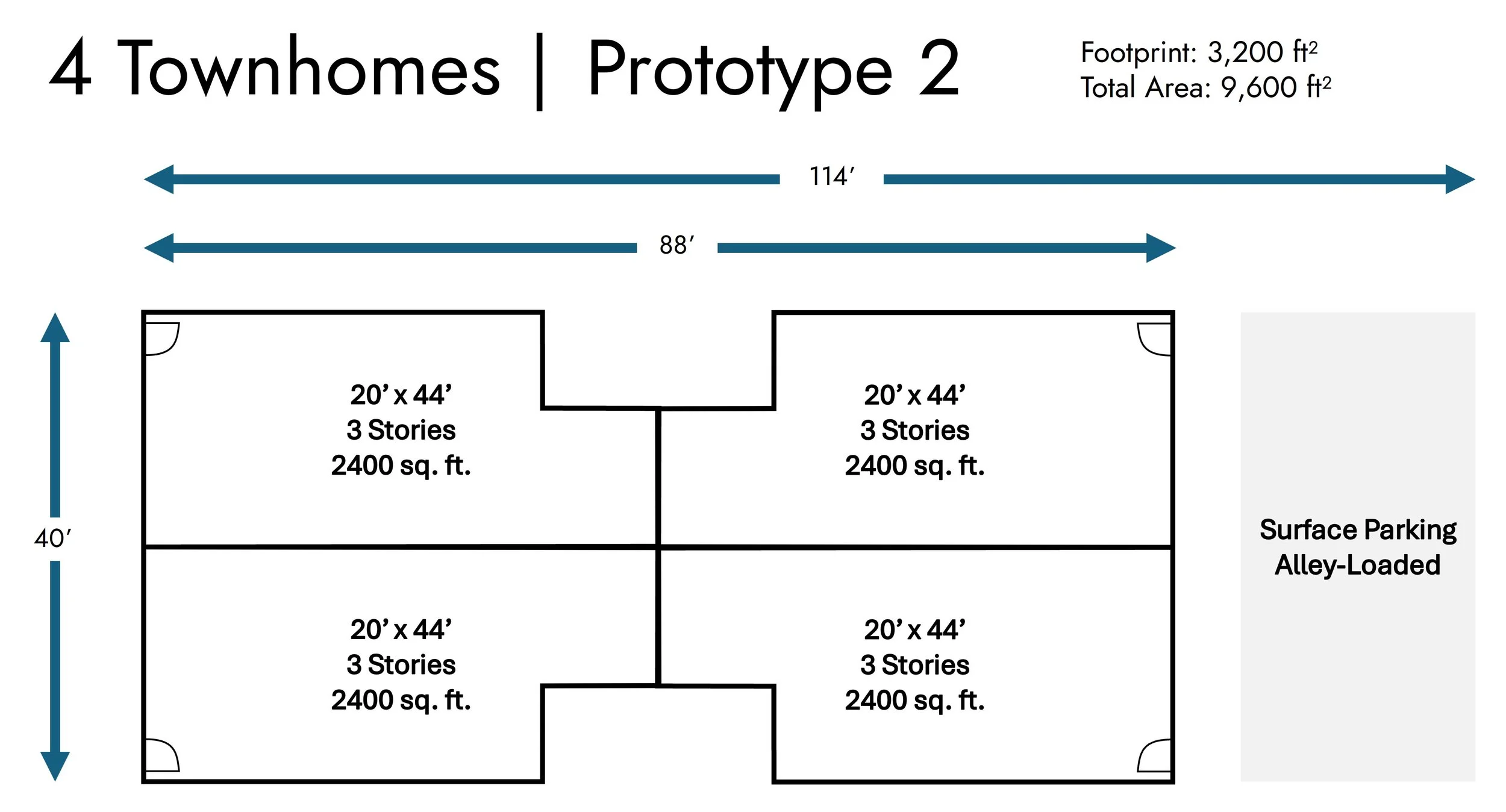

| MISSING MIDDLE | 3 Townhomes | 3 Townhomes | 4 Townhomes | 4 Townhomes | 4 Townhomes | 5 Townhomes | 5 Townhomes | 6 Townhomes | 6 Townhomes | |

|---|---|---|---|---|---|---|---|---|---|---|

| PROTOTYPES | Prototype 1 | Prototype 2 | Prototype 1 | Prototype 2 | Prototype 3 | Prototype 1 | Prototype 2 | Prototype 1 | Prototype 2 | |

| # of Units | 3 | 3 | 4 | 4 | 4 | 5 | 5 | 6 | 6 | |

| Total Floor Area (sq. ft.) | 5,880 | 10,000 | 8,160 | 9,600 | 11,200 | 9,540 | 9,600 | 9,120 | 9,360 | |

| Avg. Unit Size (sq. ft.) | 2,040 | 3,333 | 2,040 | 2,400 | 2,800 | 1,908 | 1,920 | 1,520 | 1,560 | |

| Largest Unit (sq. ft.) | 2,040 | 3,600 | 2,040 | 2,400 | 3,200 | 2,880 | 2,160 | 2,040 | 1,560 | |

| Smallest Unit (sq. ft.) | 2,040 | 3,200 | 2,040 | 2,400 | 2,400 | 1,260 | 1,800 | 1,260 | 1,560 | |

| CONSTRUCTION COSTS | ||||||||||

| Site Work | $82,815 | $79,172 | $93,155 | $83,175 | $83,015 | $88,495 | $94,175 | $91,635 | $93,455 | |

| Frame + Finish | $1,157,820 | $1,743,320 | $1,541,360 | $1,691,600 | $1,994,600 | $1,687,840 | $1,676,600 | $1,681,520 | $1,671,560 | |

| Electric+HVAC+Plumbing | $151,298 | $239,600 | $212,464 | $238,240 | $269,780 | $235,716 | $235,340 | $229,648 | $231,044 | |

| General Conditions | $217,032 | $297,451 | $271,637 | $291,562 | $331,687 | $291,446 | $290,734 | $290,336 | $289,527 | |

| Contingency | $139,193 | $206,209 | $184,698 | $201,302 | $234,740 | $201,205 | $200,612 | $200,280 | $199,606 | |

| TOTAL COST | $1,748,158 | $2,565,752 | $2,303,314 | $2,505,878 | $2,913,822 | $2,504,702 | $2,497,460 | $2,493,420 | $2,485,192 | |

| Per Total Square Foot | $286 | $257 | $282 | $261 | $260 | $263 | $260 | $273 | $266 | |

| Per Unit Average | $582,719 | $855,251 | $575,829 | $626,470 | $728,455 | $500,940 | $499,492 | $415,570 | $414,199 | |

| SELL-OUT | ||||||||||

| Total Sell-Out | $2,533,297 | $3,866,070 | $3,250,852 | $3,680,089 | $4,403,601 | $3,727,051 | $3,795,101 | $3,757,348 | $3,729,428 | |

| Per Total Square Foot | $414 | $387 | $398 | $383 | $393 | $391 | $395 | $412 | $398 | |

| Per Unit Average | $844,432 | $1,288,690 | $812,713 | $920,022 | $1,100,900 | $745,410 | $759,020 | $626,225 | $621,571 | |

| Largest Unit | $844,432 | $1,391,785 | $812,713 | $920,022 | $1,258,172 | $1,125,148 | $853,898 | $840,459 | $621,571 | |

| Smallest Unit | $844,432 | $1,237,142 | $812,713 | $920,022 | $943,629 | $492,252 | $711,581 | $519,107 | $621,571 | |

| LAND REVERSION VALUE | $435,507 | $787,167 | $486,875 | $673,035 | $907,015 | $721,409 | $798,148 | $765,244 | $747,197 | |

Analysis of Missing Middle Prototypes

+ Development Feasibility

Missing Middle prototypes were analyzed for feasibility by comparing the land reversion value for each prototype against the current estimated value of eligible parcels.

A ten percent margin of variance was applied to the land reversion value for each prototype to account for potential differences in site conditions, builder efficiency, and profit expectations.

Parcels marked viable are those for which the current estimated value is less than the land reversion value inclusive of the margin of variance.

Parcels marked marginal are those for which the current estimated value is within the land reversion value margin of variance.

Parcels marked non-viable are those for which the current estimated value exceeds the land reversion value inclusive of the margin of variance.

Viability for each prototype can be observed in the dashboard.

Takeaways from the Feasibility Analysis

A number of parameters for Missing Middle regulation can be deduced from this analysis:

At least 6,000 square feet of total floor area will be required for widespread viability of Missing Middle development

Each prototype requires three stories to achieve this amount of floor area, due to typical buildable footprints based on currently mandated setbacks

Three stories may exceed the height desired by the community, particularly south of South Street and west of 12th Avenue South

Limitation of height to two stories or less will diminish viability unless accompanied by adjustments to setback standards

The relationship between unit count and feasibility will not be linear

Land reversion value corresponds more closely to total floor area than the number of units

Site geometry and aspects of marketability—such as dedicated off-street parking, outdoor spaces, and separation between units—may present challenges to achieving higher unit counts

The most economically viable prototype is a four-unit townhome development with 2,800 square foot average unit sizes—this prototype does not provide differentiated product compared to existing housing options

Missing Middle types could substantially lower the entry point to homeownership in Edgehill, but will not be accessible to households below 125% AMI

The market-driven need for dedicated off-street parking drives ground-oriented housing types toward larger units, as parking is difficult to efficiently arrange on small sites; builders are more comfortable with fewer, larger units with dedicated parking than untested forms

Prices correspond to unit size—larger units are most likely to be developed under modest Missing Middle zoning in Edgehill

When projects include 5+ units, a more diverse mix of unit sizes is viable—Missing Middle policy in Edgehill should consider a sliding scale for allowable floor area based on the number of units to incentivize projects with a mix of unit sizes and smaller average unit sizes

Development will be unevenly distributed across the neighborhood—a fine-tuned approach will be required

Viable parcels are concentrated on 15th Avenue South between Edgehill Avenue and Wedgewood Avenue, as well as the area between 14th and 12th Avenues and South Street and Edgehill Avenue

These areas should receive the most attention as the Urban Design Overlay is developed

How to Approach Missing Middle in Edgehill

Overall, there is limited viability for Missing Middle in Edgehill. The most economically potent form of development is likely to be four townhomes with large units; in this analysis, this form (Prototype TH4-3) produced a land reversion value more than $100,000 greater than the next-highest prototype. This suggests that similar forms will predominate, as other forms will be unable to outbid for land acquisition. At full build-out, the neighborhood will only add around 500 units if four-unit townhome projects are the predominant form.

These factors raise a number of questions.

Is it worth the resources to develop a Missing Middle strategy and Urban Design Overlay that will be unlikely to deliver more than 500 units?

Is it desirable to enable development that delivers more of the same housing types? Can effective adjustments be made to deliver diverse housing options?

These questions will be explored further in a companion policy brief: Policy Design for Diverse Housing Options in Edgehill